Polley Wealth Management

Polley Wealth Management is an independent, fiduciary, provider of private wealth management, financial coaching, financial planning, and virtual family office services. We have been recognized as a Best of Orlando - Financial Consultant, Best Financial Advisors in Orlando and Top Wealth Manager - Orlando.

For almost three decades, our advisors have been partnering with clients to provide sound, professional and unbiased financial coaching, advice, investment management and life-focused wealth planning.

Our philosophy has remained unchanged through the years and that is to make what can be a complex process, straightforward and easy to understand. We partner with you and expert, third-party professionals to ensure that you benefit from the best available financial services. We challenge the methods in which traditional, and non-traditional, financial firms provide services to meet the needs of their clients.

We specialize in building, and preserving, wealth through comprehensive financial, risk management and asset protection strategies utilizing the most tax-advantaged methods available. We are independent and impartial financial advisers who put your needs first while delivering large institution-quality services, investments and expertise not previously available to individual investors. We are here to assist you as a true fiduciary, meaning, we do not have any allegiance to any bank, mutual fund company, insurance company, or any entity other than you, our client.

Why Is Fiduciary Responsibility Important?

Fiduciary responsibility is important because it ensures that the person advising you and managing your money is also making the best choices for you in terms of products and fees. As fiduciaries, we are legally obligated to put your interests above our own and to disclose any potential conflicts of interest.

Some financial advisers operate under a lesser standard known as the suitability standard. The suitability standard only requires that an investment be ‘suitable’ for a client. These financial advisers are not required to disclose potential conflicts of interest or make a client aware of less expensive or more tax-efficient alternatives. This is a common source of confusion. No matter whether a financial adviser adheres to a fiduciary standard or a suitability standard, they can call themselves a financial advisor.

Our financial advisers have a fiduciary obligation to you and there is a difference when you are not affiliated with a bank, brokerage firm, mutual fund company, or insurance company.

We started with the purpose of providing something different, and better, in private wealth management. A true fiduciary for affluent and high-net-worth professionals, executives and business owners. There is a difference when you work with Polley Wealth Management. We work for you and put you at the center of everything we do.

Start the conversation by booking an introductory meeting today!

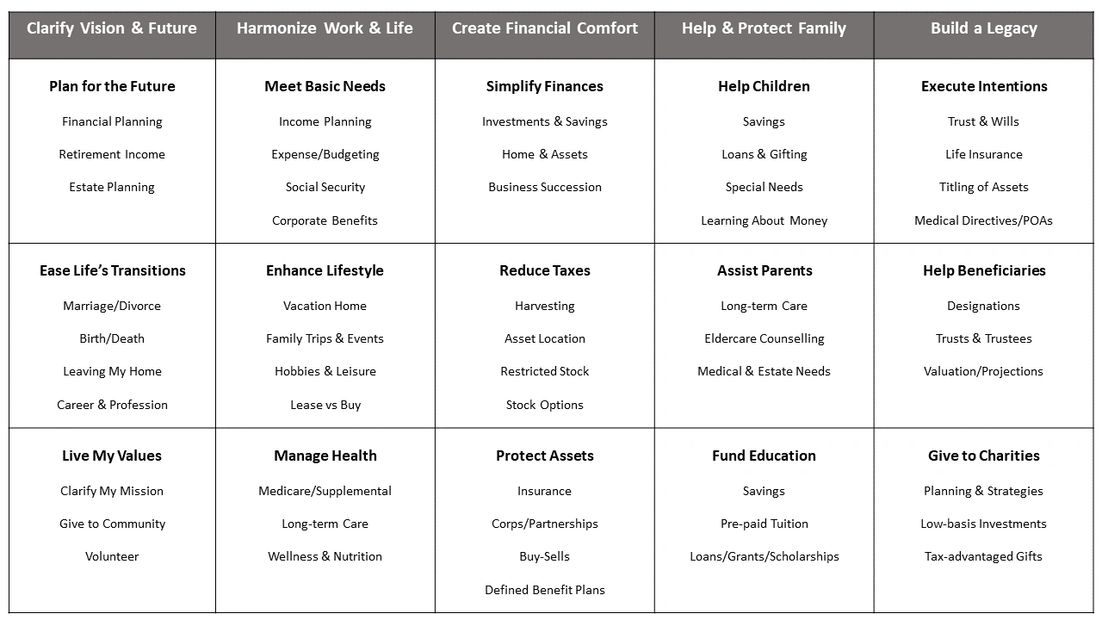

What We Do

The Value of Advice

A wealth management professional can bring clarity, objectivity, and efficiency to your financial life. Our financial advisers can help keep you focused on your long-term financial goals and put you in the best position to have a good outcome. Quality financial advice can profoundly impact your financial experience and deliver value that transcends your total wealth.

• The value of a wealth management and financial planning adviser goes well beyond investment selection and asset allocation.

• There is value in the time and resources required to manage your total financial life.

• It’s hard to put a price on peace of mind.

Why Hire an Adviser?

Hiring a financial adviser is much like delegating other tasks to specialists. Although you may be able to do the work yourself, you can benefit from a professional’s knowledge, experience, and attention to detail, and in the process, reclaim precious time for higher-priority activities: exercise, go to your kids' soccer game, spend quiet time at home, take vacations, grow personally, improve your professional skills, enjoy your retirement, volunteer your time to worthy causes, meditate, read great books, have dinner with friends.

Working with a wealth management and financial planning adviser also can make you a more knowledgeable investor, which is comparable to a personal coach helping an elite athlete fine-tune his or her skills and apply discipline in training.

Research confirms that higher levels of wealth are achieved by those who use wealth management and financial planning advisers on an ongoing basis. These investors have better savings habits and are more confident in their ability to meet their financial goals and retirement income needs.

Some of the benefits include:

- Organization. We will help bring order to your financial life, by assisting you in getting your financial house in order (at both the “macro” level of investments, insurance, estate, taxes, etc., and also the “micro” level of household cash flow).

- Accountability. We will help you follow through on financial commitments, by working with you to prioritize your goals, show you the steps you need to take, and regularly review your progress towards achieving them.

- Objectivity. We bring insight from the outside to help you avoid emotionally driven decisions in important money matters, by being available to consult with you at key moments of decision-making, doing the research necessary to ensure you have all the information, and managing and disclosing any of our own potential conflicts of interest.

- Proactivity. We work with you to anticipate your life transitions and to be financially prepared for them, by regularly assessing any potential life transitions that might be coming and creating the action plan necessary to address and manage them ahead of time.

- Education. We will explore what specific knowledge will be needed to succeed in your situation, by first thoroughly understanding your situation, then providing the necessary resources to facilitate your decisions, and explaining the options and risks associated with each choice.

- Partnership. We attempt to help you achieve the best life possible but will work in concert with you, not just for you, to make this possible, by taking the time to clearly understand your background, philosophy, needs and objectives, work collaboratively with you and on your behalf (with your permission), and offer transparency around our own costs and compensation.

One of the best decisions you can make, is to work with a qualified wealth management adviser at Polley Wealth Management.

Our Advisors in the News

Sean Polley

A sample of quotes and appearances

Polley Wealth Management

250 N. Orange Ave. Suite 1116, Orlando, FL 32801, United States

PH: 407.337.1085 Toll-Free: 844.337.1116

Hours

Open today | 09:00 am – 05:00 pm |

Copyright © 2025 Polley Wealth Management LLC - All Rights Reserved.

Services are offered through Polley Wealth Management LLC, a Registered Investment Adviser and independent financial advisory firm, headquartered in Orlando, Florida.

Cookie Policy

This website uses cookies. By continuing to use this site, you accept our use of cookies.